Selecting

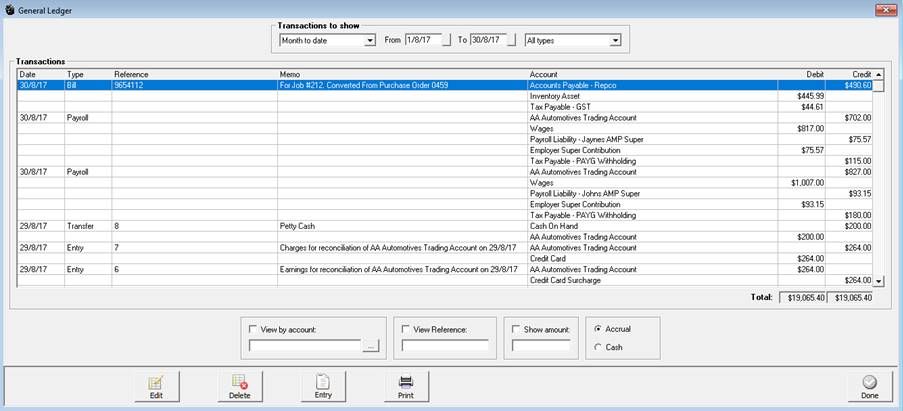

general ledger will allow you to view transactions. The general ledger

screen displays all transactions in detail including the debit / credit

account posting.

Selecting

general ledger will allow you to view transactions. The general ledger

screen displays all transactions in detail including the debit / credit

account posting.General Ledger, Overview: The general ledger is the core of your company’s financial records. These constitute the central “books” of your system, and every transaction flows through the general ledger. These records remain as a permanent track of the history of all financial transactions since day one of the life of your company.

Automation’s accounting system has a number of subsidiary ledgers (called sub-ledgers) for items such as cash, accounts receivable, and accounts payable. All the entries that are entered (called posted) to these sub-ledgers will transact through the general ledger account. For example, when a credit sale posted in the account receivable sub-ledger turns into cash due to a payment, the transaction will be posted to the general ledger and the two (cash and accounts receivable) sub-ledgers as well.

There are times when items will go directly to the general ledger without any sub-ledger posting. These are primarily capital financial transactions that have no operational sub-ledgers. These may include items such as capital contributions, loan proceeds, loan repayments (principal), and proceeds from sale of assets. These items will be linked to your balance sheet but not to your profit and loss statement.

Setting Up: There are two issues you need to be aware of when setting up the general ledger. One is their linkage to your financial reports, and the other is the establishment of opening balances.

The two primary financial documents of any company are their balance sheet and the profit and loss statement, and both of these are drawn directly from the company’s general ledger. The order of how the numerical balances appear is determined by the chart of accounts, but all entries that are entered will appear. The general ledger accrues the balances that make up the line items on these reports, and the changes are reflected in the profit and loss statement as well.

The opening balances that are established on your general ledgers may not always be zero as you might assume. On the asset side, you will have all tangible assets (the value of all machinery, equipment, and inventory) that are available as well as any cash that has been invested as working capital. On the liability side, you will have any bank (or stockholder) loans that were used, as well as trade credit or lease payments that you may have secured in order to start the company. You will also increase your stockholder equity in the amount you have invested, but not loaned to, the business.

Creating An Audit Trail: Don’t let the word audit strike fear in your heart. I am not talking about a tax audit. If you are called to respond to an outside audit for any reason, a well-maintained general ledger is essential.

But you will also want an internal trail of transactions so that you can trace any discrepancy (such as double billing or an unrecorded payment) through your own system. You must be able to find the origin of any transaction in order to verify its accuracy, and the general ledger is where you do this in Automation.

General Ledger, Accessing: To view the general ledger select accounts icon from the top of screen, point and click on general ledger to view transactions

Selecting

general ledger will allow you to view transactions. The general ledger

screen displays all transactions in detail including the debit / credit

account posting.

Selecting

general ledger will allow you to view transactions. The general ledger

screen displays all transactions in detail including the debit / credit

account posting.

Fields include:

Transactions To Show: Period or date range and transaction type

Transactions: Details include

Date:

Transaction date

Type: Includes: All types, Invoices, Receipts, Bills, Bill Payments,

Supplier credits, Deposits, Payroll, Journal entries, transfers, Credit

memos.

Reference: Invoice number or reference

Account: Chart of accounts posting

Debit: Displays accounts receiving a debit entry

Credit: Displays accounts receiving a credit entry

View by Account: Allows you to select an account from the chart of accounts

View Reference: Ability to enter an invoice, bill or reference number

Show Amount: Search for by transaction value

Functions include:

Edit: Allows the operator to view transaction details and edit entries that have not been reconciled

Delete: Ability to delete transactions that have not been reconciled

Entry: Opens the journal form

Accrual / Cash: Select your option, set to accrual as default

Done: Exits you from the screen

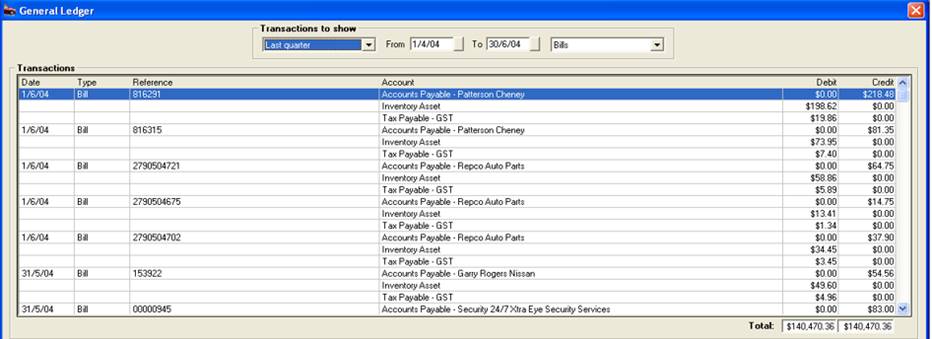

General Ledger, Selecting Transactions to View: Firstly select period or date range, the screen is set to automatically display transactions for the month to date. It is possible to select another period by clicking on the button to the right of the month to date field, from the drop down menu point and click on the period you require.

You can also select the - from to dates- by either typing into the fields at the top of form in DD/MM/YY format or selecting the button to the right of the - from / to - boxes and double clicking on the date required. Today’s date is highlighted in red, to move between months select the arrows at the top of the calendar form

Next select the type of transaction you wish to view, the default is all, and selecting the button to the right of the type field displays a drop down menu of transaction types. Highlight your choice and double click only transactions of that type are displayed for the period or date range selected. In the example below the type selected are bills and the period is month to date.

General Ledger, Totalisations: The debit and credit columns are totalised toward the bottom of the display. The debit and credit value must always be the same, totalisations relate to the transactions selected.

General Ledger, Viewing Transaction Details: It is possible to view transaction details from the general ledger. To view the original transaction details highlight an entry, point and double click on the transaction or highlight the line item and select edit (F2) from the bottom of the screen, details of the transaction are displayed in he original format they were created.

General Ledger, Editing Transactions: Transactions need to be edited from the original form, for instance if you view a closed invoice from the general ledger screen the invoice will require re-opening to change the financials.

General Ledger, Deleting Entries: You have the ability to delete an un-reconciled transaction from the general ledger. If you choose to delete transactions this way all postings are reversed. To delete a transaction highlight the record you wish to remove and select delete from the bottom of the screen, confirm the deletion at the warning message. Note: Only transactions that have not been reconciled can be deleted.

Journals, Overview: The General Journal is the most basic of journals. It is a chronological list of transactions. It has a very specific format for recording each transaction. Each transaction is recorded separately and consists of: date; all accounts to receive a debit entry are listed first with an amount in the appropriate column, then all accounts to receive a credit entry are indented and listed next with an amount in the appropriate column.

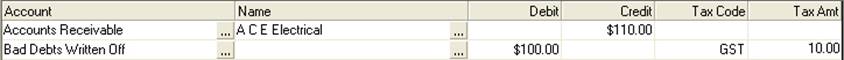

General Ledger, Creating Journal Entries: To create a new journal transaction select the Entry button from the bottom of the general ledger display or select activities / journal entries from the top menu bar. Either of these actions will display the journal form.

|

To enter transaction details select the button to the right of the first entry in the account field column. You will see a list of accounts, select the account you wish to debit or credit to, double mouse click the account name is entered into the account field. Next point at either the debit or credit fields, enter the value. ie: Trading account enter a credit of say $20.11 (according to the principles of double entry accounting a credit to your bank account will be logged as a debit in your chart of accounts).Point at the field below the last account entry and mouse click, from the account list select the account you wish to make a debit entry to, we will select bank charges enter $20.11 into the debit column. The transactions now balance and the unallocated amount is zero.

Journal Entries, Using Tax Codes: You may need to allocate an amount to tax when processing certain journals. An example would be when adjusting a client’s account to write off a bad debt, say the amount to be written off was $110.00 you would credit the clients account with $110.00 and split the opposing debit entry between an expense account ($100.00) and GST ($10.00).

To apply tax to a journal select the tax code field click on the down arrow, next point and click on the required tax code, the tax amount is automatically calculated and placed into the tax amount field. Tax is calculated on the value of the debit or credit entry entered on the same line.

Journal Entries, Reversing: It is all too easy to enter values in the wrong columns, the reverse function will place all the debit entries into the credit column the opposing entries will be placed in the debit column.

Journal Entries, Adjusting Debtor & Creditor Accounts: Automation allows you to adjust individual accounts assigned to accounts receivable (Debtors) and accounts payable (Creditors) with a journal entry. The entries are recorded in the bill payments (creditors) and Receive Payments (Debtors) forms, payments and receipts can be allocated to these transactions in the same way as process bills and invoices.

To adjust a debtors account select the button to the right of the account field, from the chart of accounts select accounts receivable, the name field can now be accessed, point and click on the button to the right of the field, from the client list select the client you wish to raise the adjustment for, select OK from the bottom of the client listing. The clients name is now displayed in the form.

If you wish to increase the balance of a debtors account place the value (in tax) into the debit column on the same line as the client’s name. Next select the account you wish to post to if there is a tax value enter the excluding tax amount to the debit column on the same line, to enter the tax value select the tax code and the calculated value is automatically entered in the tax amount field. Note: That the tax and debit or credit value can be changed, however the total credits must always be equal to the total debits for the transaction to be posted.

Journal entries are displayed in the following format on the bill payment and receive payment forms

Receipts (Debtors)

Bill Payments (Creditors)

Ticking the box at the end of the line allows the operator to allocate payments or receipts to a journal.

General Ledger, Journal Entries Editing: To edit a journal go to the general ledger by selecting the accounts / general ledger option from the top menu bar. Search for the entry you require, highlight and double click on the line item or select edit from the lower menu bar. You can now alter any of the details except the reference number.

General Ledger, Journal Entries Displaying: To view journal entries only from the general ledger display select the arrow to the right of the field at the top of screen displaying All Types – select journals from the drop down list. To filter journal entries by date select the field at the top of the screen-displaying month to date. Select the arrow to the right of the text. Next highlight the period you wish to view or alternatively type from to dates into the date fields also located at the top of the form – selecting the arrows on the right hand side allows you to pick from a calendar. Pointing and double clicking on an entry displays the details.

General Ledger, Accounts Overview: A chart of accounts is a list of the categories of financial transactions for a particular business. These categories are grouped as:

1) Asset Accounts - things of value owned by the business.

2) Liability Accounts- amounts owed to outsiders.

3) Owner's Equity Accounts - amounts owed by the business to its owners (profit). If the business loses money the owners may owe additional money to the business.

4) Revenue Accounts - Sources of income.

5) Expense Accounts - Payments necessary to run the business.

Proper accounting practice requires a double entry accounting system. This means that each value input into the system is a credit (-) to one general ledger account and a debit (+) to another. Since each entry affects two accounts by the same amount, debiting one and crediting another, the accounts are always in balance. Another way to look at accounting is to view the chart of accounts as a row of jars lined up along a wall with a label on each jar. The first jar might be labeled "Bank Account". One further down the line might be labeled "Phone Expenses". If a phone bill is paid the accounting system takes an amount of money out of the "Bank Account" jar and puts it into the "Phone Expenses" jar. Thus it can be seen that the sum of the credits will always be equal to the sum of the debits meaning the books will be in balance or the sum of the debits and credits together will be zero.

One might wonder where the money comes from to be transferred between jars. The point is that the jars (or accounts) start out empty and they stay empty to the extent that the sum of the money in the jars is always zero. A credit to one account is offset by a debit to another so that we have +1-1=0.

Automation Accounts are set up in this way

Asset accounts carry a debit balance (+)

Liability accounts and owner's equity accounts carry a credit balance (-)

Revenue accounts carry a credit balance (-)

Expense accounts carry a debit balance (+)

Credits = Debits

Assets = (liabilities + owner's equity)

Owner's equity = Capital input + profit

Profit = Revenues + expenses (revenues are negative and expenses are positive)

Assets + liabilities + capital input + revenues + expenses = Zero

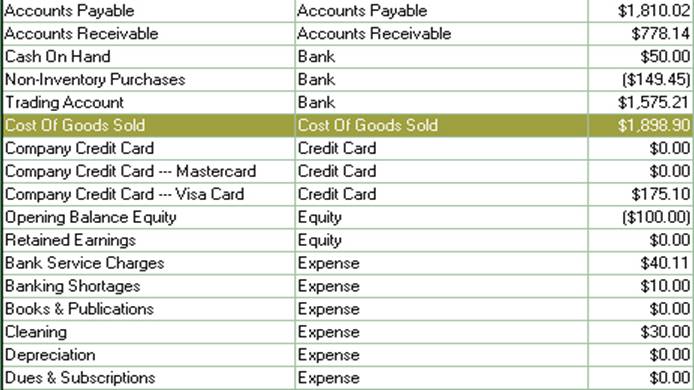

General ledger, Viewing Transactions By Account: To view the transactions associated with a general ledger account select either the account filter from the general ledger transaction display or select lists / chart of accounts.

General Ledger: From the bottom of the general ledger screen select the button to the right of the view by account option. The chart of accounts is now in view, highlight the account and confirm with OK (F12) point and click on the check box above the field. Only transactions relating to the selected account are in view. You will need to select a period or date range if you wish to view transactions pre month to date.

Chart Of Accounts:From the chart of accounts list point and double click on the account you wish to view or alternatively highlight select edit (F2) from the bottom of the list. The account details form is displayed.

To

view transaction details select the ledger button at the bottom of the

form. The general ledger screen is opened displaying related posting for

the month to date if you wish to view transactions pre current month you

need to select a new period or enter a date range.

To

view transaction details select the ledger button at the bottom of the

form. The general ledger screen is opened displaying related posting for

the month to date if you wish to view transactions pre current month you

need to select a new period or enter a date range.

Chart Of Accounts, Creating New Accounts: From the bottom of the accounts listing select new, this action opens the account details form enter the name of the account ie: Office equipment, next you have the opportunity to enter the opening balance.

General Ledger, Creating Sub Accounts: If you wish to attach an account to a “parent” select the arrow to the right of the sub-account field. A list of accounts is displayed, highlight the account you require and double mouse click. The account will appear in your chart of accounts as a sub account. Ie Depreciation -- Hoist

You may want to use sub-accounts for two reasons:

You want a further breakdown of amounts for an existing account. To accomplish this, set up sub-accounts of the existing account. From now on, use the sub-accounts instead of the parent account. (You may want to edit earlier transactions so the breakdown shows up on reports covering a period before today.) For example, suppose you have an Insurance expense. You add sub-accounts for building, equipment and personal

You already have related accounts that you want to subtotal on reports (Or you may want to find them more easily). You set up a new parent account and then make the related accounts sub-accounts of the new parent.

General Ledger, Viewing Accounts: From the top of screen select Lists / Chart Of Accounts, your general ledger accounts are listed including current balances.

Bank Deposits, Overview: When you receive payments, whether for jobs, invoices, or cash sales, you can either show them as deposited into a bank account, or you can wait until the end of the day or end of the week to deposit the money you've collected. Automation allows you to choose the method you prefer for depositing payments.

When you are deciding on the method to use to deposit payments, think about how your bank statements show deposits. You should select the deposit method in Automation that imitates your bank statements to make it easier for you to reconcile your bank accounts.

For example, if the bank statement shows a lump sum for a deposit, you should group payments with other funds for deposit; if the bank statement shows each individual cheque that was deposited, you should choose to deposit directly to an account.

You can choose an account to deposit payments to from the payments receipts form, if you select a bank account from the drop-down list, Automation automatically records a deposit for the amount of the payment in the account you selected on the date you received the payment.

If you accept the default account - undeposited funds, Automation holds your undeposited funds in a other current asset account called Undeposited Funds until you record a deposit.

Bank Deposits, Viewing Payment Receipts: Select the accounts icon from the top of the screen, from the menu click on receipts. Displayed are individual customer payments, refunds and cash payments made to suppliers from undeposited funds.

The account field displays the amount as being allocated to a other current asset account title undeposited funds or an account the amount has been deposited to ie: Trading account. To view details of the payment highlight the record and double click or select edit (F2) from the bottom of the display. To

Bank Deposits, Filtering Payment Receipts: The receipts screen is set to automatically display transactions for the month to date.

By Date / Period: It is possible to select another period by clicking on the button to the right of the month to date field, from the drop down menu point and click on the period you require. You can also select the - from to dates - by either typing into the fields at the top of form in DD/MM/YY format or selecting the button to the right of the - from / to - boxes and double clicking on the date required. Today’s date is highlighted in red, to move between months select the arrows at the top of the calendar form.

Undeposited Funds:Refers to all receipts that have not yet been deposited to a bank account. To view only undeposited items point and click on the undeposited check box at the top of screen.

To

reverse your selection point and click on the tick in the undeposited

only check box.

To

reverse your selection point and click on the tick in the undeposited

only check box.

Unallocated: Selecting this filter from the top of screen displays only receipts that have not been allocated to invoices. Unallocated amounts are indicated by a red cross in the allocated column instead of a green tick.

Selection

allows you to view all unapplied credits recorded in the receipts screen.

Selection

allows you to view all unapplied credits recorded in the receipts screen.

Client: It is also possible to filter receipts by single client Select the button to the right hand side of the client field, your client listing is displayed. Highlight the client you wish to select confirm with OK (F12) only transactions relating to the chosen client are displayed.

Select

the check box above the client field to view.

Select

the check box above the client field to view.

Bank Deposits, Processing: It is possible to bank money directly to a bank account from the payment receipt form as you are processing a payment. To change the undeposited funds default account select the button to the right of the account field, a list of bank and other current asset general ledger accounts is in view, highlight the account you wish to deposit the funds to and confirm your selection with OK (F12).

Alternatively a bank deposit for a group of received payments can be created from the receipt screen by clicking on the deposit button from the bottom menu bar or by selecting Banking / Deposits.

Receipts

Screen: Select

deposit from the bottom of the display, the deposit form opens listing

all undeposited funds recorded. To process a deposit, payments can be

selected individually or you have the option to flag all by using the

all button located at the bottom of the form.

Receipts

Screen: Select

deposit from the bottom of the display, the deposit form opens listing

all undeposited funds recorded. To process a deposit, payments can be

selected individually or you have the option to flag all by using the

all button located at the bottom of the form.

Click

on the all button to flag all records for deposit, selection is indicated

by a tick in the check box field of the transaction.

Click

on the all button to flag all records for deposit, selection is indicated

by a tick in the check box field of the transaction.

Bracketed values indicate credits (money returned to clients and now missing from undeposited funds or supplier payments paid from the undeposited funds account the deposit details display the date, account, selected account current balance and a text memo field.

Deposit Details: Allows for entry of the date, account plus provides a texts memo field.

Date Selection: Type the date in DD/MM/YY format or select the button to the right of the date field and click on the date from the calendar display.

Trading Account: To change the deposit account select the button to the right of the account field and highlight a record from the list confirm with OK (F12).

Balance: Locked field recording the current balance of the account displayed.

Memo: Is a free typing field

Navigating Transactions: Select the previous and next buttons if you wish to scroll through transactions. If you wish to enter more than one deposit completing the transaction with next will open a blank form.

Deposit Summary: Displays totals of the various media types and a grand total of all media components of the deposit. When negative values i.e.: ($10.20) is selected from the deposit items window the value of deposit will decrease, therefore allowing you to reconcile the true cash value on hand.

Finalising: To finalise a deposit select OK (F12) from the bottom of the deposit form. You are returned to the receipt screen displaying the deposit account against each transaction processed

Before printing ensure these details are entered in your site configuration. To print your deposit slip select the receipt print button from the bottom of the form. Your bank details, cheques and other payment media are entered for you allowing you to deposit without manually completing a deposit slip.

Banking / Deposits:Alternatively the deposit form can be accessed by selecting the banking icon at the top of the screen and clicking on deposits. The deposit form opens displaying all undeposited funds, select the items you wish to bank, print the slip and accept with OK (F12).

Bank Deposits, Printing A Deposit Slip: Automation allows you to enter your bank details into the site settings by selecting the configuration tab and completing the banking section of the form.

Deposits, Viewing: To view a list of deposits select the banking icon at the top of the screen and click on deposits. The deposit screen lists all deposits for the current month. You can view the details of a deposit by highlighting the entry and double clicking or selecting edit (F2) from the bottom of the display. Deposits can be edited from the deposit form displayed; however any changes will affect the current bank balance. Note: It is not possible to alter a reconciled deposit.

Deposits, Viewing By Date Range: It is possible to select another period by clicking on the button to the right of the month to date field, from the drop down menu point and click on the period you require. You can also select the - from to dates - by either typing into the fields at the top of form in DD/MM/YY format or selecting the button to the right of the - from / to - boxes and double clicking on the date required. Today’s date is highlighted in red, to move between months select the arrows at the top of the calendar form.

Deposits, Deleting: it is possible to delete a deposit from either the general ledger display or deposit slip. If deleting from the general ledger highlight the transaction and select delete from the bottom of the display. To delete from the deposit form, open the deposit you wish to delete and select the delet button located at the bottom of the form.

Bank Transactions, Viewing: To view bank account transactions select the banking icon from the top of screen, click on transactions from the menu. The banking screen displays all transactions month to date for your trading account.

You can view the details of a transaction by highlighting the entry and double clicking or selecting edit (F2) from the bottom of the display. Transactions can be edited from the forms displayed; however any changes will effect associated transactions. As an example if you alter a payment allocated to an invoice the outstanding balance of the invoice will change accordingly. Note: It is not possible to alter a reconciled transaction; reconciled items are indicated by a green tick at the end of the line entry.

Bank Transactions, Selecting A Date Range: It is possible to select another period by clicking on the button to the right of the month to date field, from the drop down menu point and click on the period you require. You can also select the - from to dates - by either typing into the fields at the top of form in DD/MM/YY format or selecting the button to the right of the - from / to - boxes and double clicking on the date required. Today’s date is highlighted in red, to move between months select the arrows at the top of the calendar form.

Bank Transactions, Account Selection: The bank transaction screen allows you to select a bank or credit card account. Click on the button to the right of the account field from the select account list highlight the required entry and confirm your selection with OK (F12). The new account name is displayed in the account field including the current balance and associated transactions for the period selected.

Bank Transactions, Debits & Credits Selection: Automation allows you to view credits and debits for the selected account or credits, or debits only. Select the button to the right of the debits & Credits field click on your selection from the drop down menu.

Bank Transactions, Transferring Funds: You can transfer funds between any two balance sheet accounts. For example, you may need to transfer funds from a savings account to a current account to cover your weekly payroll.

1) From the bottom of the bank transaction screen select Transfer

2) Enter the amount you want to transfer

3) Select a media type from the drop down menu

4) Select an account to transfer funds from, and an account to transfer funds to.

5) Click OK (F12).

Bank Transactions, Editing A Transfer: Highlight the transaction and double click, or select edit (F2) from the bottom of the screen, make the necessary adjustments as required and save your changes with OK (F12).

Note: Only transfers that have not been reconciled or allocated on the bill payment or receipts form can be deleted.

The

transfer button located at the bottom of the screen opens the transfer

form. The funds transfer form allows you to transfer money between accounts

and allocate a media type. To make financial adjustments between accounts

where you do not want to record a media type use the journal entry function

The

transfer button located at the bottom of the screen opens the transfer

form. The funds transfer form allows you to transfer money between accounts

and allocate a media type. To make financial adjustments between accounts

where you do not want to record a media type use the journal entry function

Bank Reconciliation, Overview: Automation allows you to reconcile bank or credit card transactions against your statement. It is important that you structure your payments and deposits as close as possible to your bank statement entries. For instance your bank may clear EFT transactions on a daily basis, to ensure deposits match your bank statement deposit all EFT receipts daily to your bank account. You may have direct debits that are automatically withdrawn from your account, again make sure you enter these as they become due; selecting direct as the payment media will easily identify these entries.

You need to be aware that Automation enforces certain restrictions when editing reconciled transactions. Once a receipt that is part of a reconciled deposit or a bill with an assigned payment which has been reconciled the following rules apply.

Transaction Value: Not able to be changed

Transaction Media: Unable to be altered

Transaction Date: Unable to move to an alternative date

Bank or Credit Card Account: Unable to move to an alternative account

Bill Payments: You can however open a reconciled bill payment and re-assign payments or select an alternative supplier, in this situation all payment allocations to the original supplier invoices will be removed and you will need to re-assign the payment value to invoice or journals outstanding for the new supplier.

Bills: Reconciled bills can be re-opened and items and suppliers changed, however the total value of the invoice must always be the same for the changes to be recorded.

Receipts: It is also possible to open receipts that have been deposited for which the deposit has been reconciled. Allocations can be changed plus you have the option to select a new client and assign the amount received to outstanding invoices on the new account.

When you have completed reconciling the closing balance must equal the equivalent balance on your bank or credit card statement. It is possible to process transactions such as bank charges directly from the reconciliation screen.

To avoid corrupting the integrity of your data you are unable to edit any reconciliation beyond the very last one performed. This feature does give you the opportunity to make changes just in case you committed an incorrect reconciliation.

Bank Reconciliation, Accessing: Bank reconciliation can be started from either the bank transaction screen by selecting the reconcile button at the bottom of the display.

Selecting

reconcile from the bank transaction screen opens the reconcile function.

Selecting

reconcile from the bank transaction screen opens the reconcile function.

Alternatively you can go directly to the reconcile function by selecting Activities / Reconcile from the top of the screen. You will need to select an entry from the account list if you open the screen from the activities menu.

Bank Reconciliation, Processing: First ensure you are viewing the correct account then perform the following:

1) The opening balance should be the same as the opening balance of your current statement (the closing balance of your last reconciliation).

2) Enter the closing balance of your statement into the closing balance field – the difference field will display the difference between the two values. Bracketed values are negative ie ($45.60).

3) Point and click on the selection field at the end of the line item as you mark off the matching entries on your bank statement. Note: Credits are deposits or money transferred to your account / Negatives relate to payments ie: Cheques and direct debits.

4) Check the difference is zero – finalise with OK (F12)

Bank Reconciliation, Adding Transactions: If you need to enter additional transactions to balance your reconciliation use the credit or debit fields located in the additional transactions section of the screen.

A value entered in the credit field will increase your closing balance, entering a value into the debit field will decrease your bank balance. Select the button to the right of the field to display your general ledger accounts, highlight your selection and confirm with OK (F12).

Date Editing - Automation allows for editing of the reconciliation date field, once reconciliations are re-ordered the opening balances will re-calculate from the closing balance of the last reconciliation based on date hierarchy.

Bank Reconciliation, Searching Transactions: To search for a specific record enter the reference or value into the search fields located at the bottom of the form, point and click on the button to the right of the field, the cursor will highlight each record that matches your entry. Click on the double arrow to initialise the search function. To display credits or debits only select the arrow to the right of the show field, highlight the required entry and double mouse click.

Bank Reconciliation, Viewing Transaction Details: Highlight the line entry and double click or select edit from the bottom of the display. Transactions can be edited from their respective forms; changes will be entered directly to the current reconciliation.

Bank Reconciliation, Posting Discrepancies: If you complete the reconciliation with the closing balances between your accounts and the bank statement not equaling zero a message will request whether you wish to continue or not. Selecting yes will post the difference to opening balance equity, if you wish to adjust this posting you are required to raise a journal entry.

Overview

Automation allows you to perform an automated bank reconciliation using a CSV or Qif file that can be downloaded from your online banking portal. On choosing the import option you will need to point to the location where you saved your transaction file, once selected the reconciliation process will run a comparison between what has been entered locally and your bank download the transaction that are matched are flagged in the reconciliation screen.

When using this feature, it is imperative that you have a reference against the local transaction that matches the bank transaction, this can be a reference# as you pay a supplier or receive payment. Automation automatically records the client when receipts are processed, if your bank record contains these details then a match will be established. Please understand that the auto reconciliation feature will only work if your local transaction match the bank records exactly, these are based around the reference and value.

To Begin the process, you will first need to download the transaction file in either CSV or Qif format, we suggest you create a new sub folder titled bank in the C:\Automation Client folder and name your files according to the date they were downloaded ie: Recon28032019, this way you are giving each file a unique title that is easy to reference. Once you have your bank transaction file you can begin the automated reconciliation process.

Go to Bank / Reconciliation / New > Bank or credit card account, once completed you will see the normal reconciliation screen.

Reconciling, Accessing An Import File

To commence the comparison process, enter your closing balance and click on the import option from the bottom task bar, you can now navigate your PC to locate the file you downloaded and saved.

Point and double click on your transaction file, the screen will now split into two frames one displays your local transactions the other the downloaded bank transactions. Where a match has been found the transaction will be flagged on the local side of the display and ticked on the bank side.

In the above example matches can’t be made with the receipts into the bank hence the red cross against these transactions on the banking side. You can in this instance simply click on the receipt transaction correct the amount and then select the re-process option placed under the import file side of the screen. There is no need to cancel the whole reconciliation and re-do.

Once all items are flagged in your reconciliation and the transactions balance against the closing value simply close and save the results.

Bank Reconciliation, Editing & Deleting: You can only edit or delete the most recent reconciliation for each bank or credit card account. To delete a reconciliation highlight the line item from the reconciliations screen, point and click the delete option located on the lower menu bar of the display.

Automation also give you the option to edit the most recent reconciliation, to change any previously reconciled items, highlight the line entry from the reconciliations display and double click or choose edit from the lower menu bar, the reconciliation will be displayed. Make the changes including your closing balance and save with OK (F12).

Bank Reconciliation, Holding: Automation allows you to “hold” an unfinished reconciliation, select the on hold option from the top right hand corner of the reconciliation screen. Select Ok (F12) to exit, complete the reconciliation by de-selecting the on hold option.

Bank Reconciliation, Select All: To select all transactions select the All option located st the bottom of the reconciliation screen.

Selecting

all with select all outstanding un-reconciled transactions

Selecting

all with select all outstanding un-reconciled transactions

Credit Cards, Overview: Automation allows you to have multiple credit card accounts. You can pay suppliers from these accounts and reconcile your transactions against a statement. On completing the reconciliation you have an option to process payment from a bank account. The general ledger accounts contain a credit card account type which is listed under other current liabilities in your balance sheet.

Credit Cards, Creating a New Account: New credit card accounts are created from the chart of accounts list, click on new from the bottom of your listing. At the account form enter the title of the credit card ie: American Express, Master card, Visa. Select the button to the right of the type field highlight credit card and double click.

Credit Cards, Entering an Opening Balance: You are able to enter an opening balance when creating a new credit card account. Type the amount into the current balance field and confirm your entries with OK (F12). Opening balances are posted to the credit card account and opening balance equity if you wish to transfer the amount from your equity account create a journal entry.

Credit Cards, Processing A Supplier Payment: From the bill payment form select credit card as your media from the drop down menu. Next click on the button to the right of the account field highlight the credit card account you wish to process the payment from, confirm your selection with OK (F12). The record number is sequential however this can be overwritten if required

Credit Cards, Viewing Transactions: To view bank account transactions select the banking icon from the top of screen, click on transactions from the menu. The banking screen displays all transactions month to date for your trading account. To select a credit card accounts click on the button to the right of the account field and select from the account list. All transactions for the month to date are displayed, to view other records use the various filters available from the bank transaction display.

Credit Cards, Reconciling: A credit card reconciliation can be started from either the bank transaction screen by selecting the required credit card account then selecting the reconcile button at the bottom of the display. Alternatively you can go directly to the reconcile function by selecting Activities / Reconcile from the top of the screen. You will need to select a credit card account from the list, highlight and confirm with OK (F12) to open the reconcile display.

To complete the reconciliation first ensure you are viewing the correct account then perform the following:

1) The opening balance should be the same as the opening balance of your current statement (the closing balance of your last reconciliation).

2) Enter the closing balance of your statement into the closing balance field – the difference field will display the difference between the two values. Bracketed values are negative ie ($95.60).

3) Point and click on the selection field at the end of the line item as you mark off the matching entries on your credit card statement. Note: Credits are deposits or money transferred to your account / Negatives relate to payments i.e.: Cheques and direct debits.

4) Check the difference is zero – finalise with OK (F12)

Credit Cards, Reconciling Adding Transactions: If you need to enter additional transactions to balance your reconciliation use the credit or debit fields located in the additional transactions section of the screen.

A value entered in the credit field will increase your closing balance, entering a value into the debit field will decrease your credit card balance. Select the button to the right of the field to display your general ledger accounts, highlight your selection and confirm with OK (F12).

Credit Cards, Posting Reconciliation Discrepancies: If you complete the credit card reconciliation with the closing balances between your accounts and the bank statement not equaling zero a message will request whether you wish to continue or not. Selecting yes will post the difference to opening balance equity, if you wish to adjust this posting you will need to raise a journal entry.

Credit Card, Processing Payment: To process payment of your company credit card complete the reconciliation on selecting OK (F12) a prompt is displayed if you wish to process payment immediately select yes the transfer form is displayed. From the transfer form select the account you wish to process payment from. Selecting your default bank account will enter the next cheque number and the amount automatically. To complete payment select OK (F12) from the bottom of the transfer form.

Reconciliations, Viewing: To view reconciliations select the banking icon at the top of screen from the drop down menu select reconciliations a list of previous reconciliations is in view. To display the details of reconciliation highlight the line item and double click or select edit (F2) from the bottom of the display. Note: It is not possible to edit reconciliations once you have saved the results.

Reconciliations, Deleting & Editing: It is possible to delete or edit only the last reconciliation saved, all previous entries are unable to be altered. To open a reconciliation highlight the entry at the top of the list point and double click, to delete select delete and accept the action from the warning message displayed.